In recent years, plant-based milk has surged in popularity, carving out a significant share of the global milk industry. This trend is particularly strong in Australia, Singapore, and the UK, where consumers are increasingly turning to non-dairy alternatives for a variety of reasons, including health benefits, environmental concerns, and dietary preferences. On World Plant-Based Milk Day, celebrated on 22 August, our latest Focus On study uncovers the shifting dynamics of milk consumption and what it means for the manufacturers and retailers.

The Growing Popularity of Plant-Based Milk

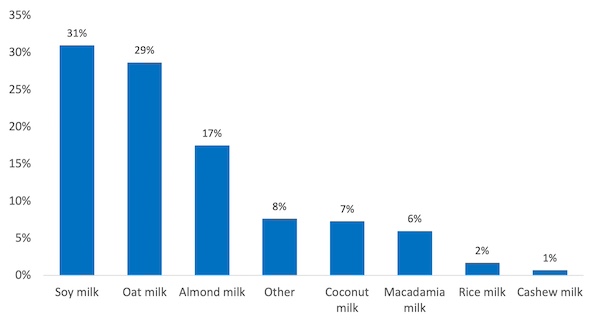

Our Focus On study, conducted across Australia, Singapore, and the UK, reveals some terrific insights into the current state of plant-based milk consumption. With many plant-based milks now available, soy milk emerges as the most popular choice, with 31% of respondents selecting it as their go-to option, closely followed by oat milk at 29% and almond milk at 17%.

Varieties Consumed

However, preferences vary significantly across regions. In Singapore, soy milk is even more dominant, with 37% of consumers favouring it, while 15% have adopted macadamia milk—a unique regional preference. In the UK, oat milk leads the pack with 38% popularity, and coconut milk enjoys a special place in the hearts of 12% of British consumers. Here in Australia, almond milk is the top choice at 31%, while only 19% of Australians turn to oat milk as their first preference.

Plant-Based plus Dairy Milk

Interestingly, 32% of respondents still consume dairy milk alongside plant-based alternatives, possibly reflecting a transitional phase in consumer habits. The potential for future shifts is also evident, with 16% of respondents switching to almond milk if their primary choice is unavailable, followed by 14% for soy milk and 10% for oat milk. Despite the variety of options available, 12% of respondents stick exclusively to one type of plant-based milk.

Key Consumer Drivers

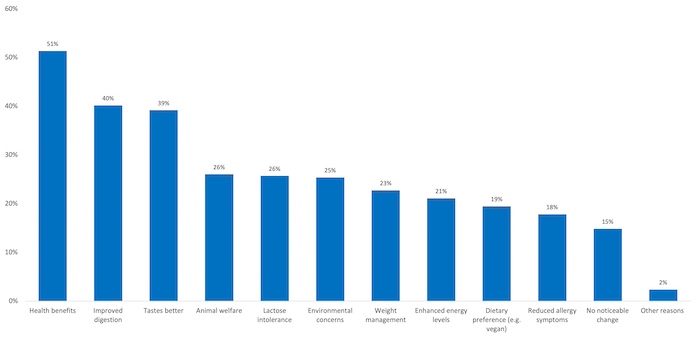

The top three reasons for choosing plant-based milk over dairy are clear: health benefits (51%), improved digestion (40%), and better taste (39%). Additionally, 19% of respondents state dietary preferences, such as veganism, as a driving factor. This trend reflects a growing awareness of the benefits of plant-based diets of these milk options over traditional dairy.

Purchase Drivers

Versatility

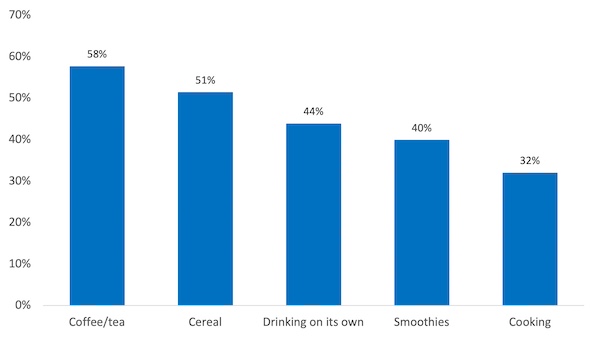

Plant-based milk is also versatile, being used in a variety of applications. It’s most commonly added to coffee or tea (58%) and cereal (51%), however a significant number of consumers (44%) also enjoy drinking it on its own.

Consumption Occasions

Singaporeans are particularly inclined to drink plant-based milk on its own (59%), while the British prefer it in their coffee or tea (66%) or on cereal (65%). Australians, on the other hand, are less likely to drink it solo (38%), but over 50% are happy to include it in their smoothies.

Consumption Patterns and Consumer Challenges

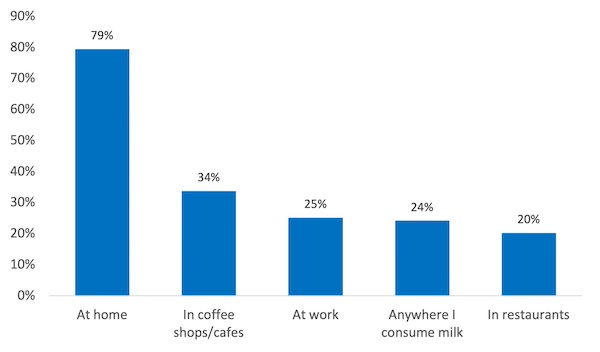

Most plant-based milk consumption takes place at home (79%), highlighting a significant opportunity for grocery retailers. The taste and texture of plant-based milk satisfy over 70% of respondents, with more than 50% considering environmental concerns as important factors in their decision-making – this figure rises to 64% in the UK.

Consumption Locations

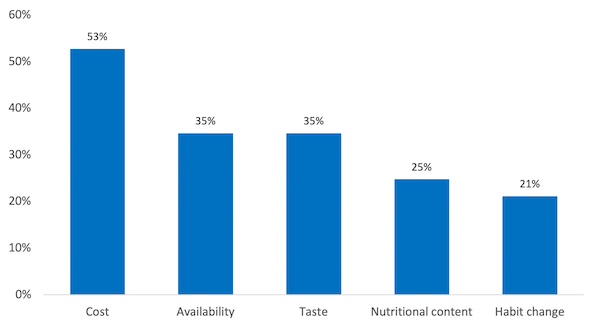

However, the switch from dairy to plant-based milk is not without its challenges. Cost is the most significant barrier, with 53% of respondents highlighting it as a concern – let’s face it on a litre-by-litre basis it’s more expensive than dairy. Taste and availability are also important factors for 35% of consumers, and changing traditional milk habits presents a challenge for just over 20% of respondents.

Consumer Challenges

In Singapore, taste and habit change are particularly pressing issues, while in the UK, availability seems to be a bigger hurdle than in other markets. In Australia, cost remains the primary barrier, with 59% of respondents indicating they would consume more plant-based milk if it were cheaper.

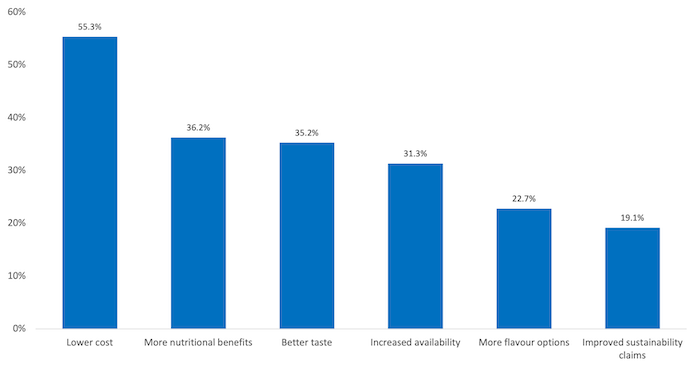

For those looking to increase their plant-based milk intake, 55% of respondents say they would do so if the cost were lower. Additionally, 36% would drink more if the milk offered better nutritional benefits, and 35% would consume more if it tasted better. In Singapore, taste and nutritional value are even more crucial, with 46% wanting better taste and 45% seeking more nutritional value.

Volume Drivers

Brand Loyalty vs. Price Sensitivity

When it comes to choosing a brand of plant-based milk, taste is the most critical factor, followed by price. Interestingly, brand reputation is less influential, with approximately two-thirds of respondents considering it non- important in their purchasing decisions. This indicates that while consumers are brand-conscious, they are price-sensitive and also prioritise taste and nutritional content when selecting their preferred plant-based milk.

Marketing Implications for Manufacturers and Retailers

The evolving landscape of plant-based milk presents opportunities and challenges for both dairy and plant-based milk manufacturers. Here are five key marketing implications:

1. Health and Nutritional Benefits: For plant-based manufacturers emphasising the health and nutritional benefits of the milk they produce is crucial. Highlighting features like added vitamins, minerals, and the absence of cholesterol can appeal to health-conscious consumers.

For dairy manufacturers, to combat the declining market share, dairy brands should also focus on the health aspects of their products, such as promoting the natural protein content and calcium in dairy milk, and consider new health related products that regain lost ground…. anyone for a fresh chocolate flavoured collagen milk?

2. Brand Building: Strong branding is essential for both plant-based and dairy milk producers. By building a recognisable and trusted brand, companies can create better value and reduce the likelihood of brand switching. Brand loyalty is particularly important in a competitive market where consumers have multiple options. Effective branding will also allow companies to command premium pricing.

3. Emphasise Taste and Texture: Taste and texture are critical factors influencing consumer choice. Plant-based mil manufacturers should prioritise these elements in product development and marketing communications. Highlighting improvements in taste and texture or showcasing customer testimonials can help attract and retain customers.

4. Education on Health and Environmental Benefits: Consumers are increasingly motivated by health benefits and environmental concerns. Educational campaigns that clearly communicate the health benefits of plant-based milk and the environmental impact of these choices can drive consumer preference.

5. Pricing Strategies: Price is a significant consideration for consumers when switching between milk types. Offering price discounts, promotions, or bundling options can encourage brand switching and product trials. Manufacturers should consider using strategic pricing to attract cost-sensitive consumers, especially in a market where many are willing to experiment with different types of milk.

There are many other insights that can be gained from this study. If you would like to know more about our Focus On Plant-Based Milk poll please contact us.