Our latest Focus On Poll delves into chocolate purchase behaviours for personal consumption across Australia, Singapore, and the United Kingdom, exploring key purchase drivers, consumption habits, and preferences. So grab your favourite box of chocolates and let’s dive in!

Why These Regions?

As regional hubs of our business, we chose these key markets to uncover the rich tapestry of chocolate-loving cultures. Each region in our poll brings its own unique flavour to the global chocolate market, yet there are also insightful similarities.

Australia boasts a mature market with a high frequency of chocolate consumption, driven by a love for indulgent treats and a broad range of products that satisfies diverse tastes.

Singapore’s chocolate market is growing, with an increasing interest in premium and health-oriented chocolates. The demand is driven by a cosmopolitan population that values quality and variety.

In the UK, chocolate is a beloved treat. The trend of consuming chocolate at home and as a comfort food is on the rise, reflecting the British love for sweet indulgences.

Sweet Temptation

Across all three regions, chocolate is a regular delight for many, with 36% of consumers including it in their shopping repertoire whilst a further 36% succumb to its allure as an impulse buy. For 28% of our respondents, chocolate is an occasional luxury, often added when savings on other items allow.

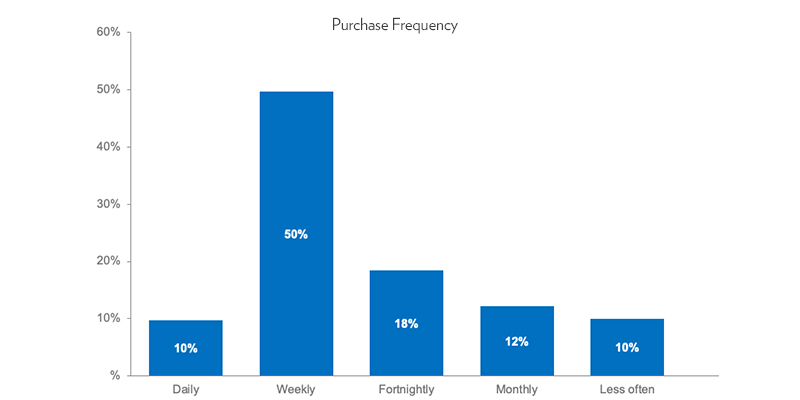

Weekly Indulgence

Half of the respondents across the three regions treat themselves to chocolate weekly. Brits lead the charge, with 63% indulging weekly, while Singaporeans show more restraint, with only 32% buying chocolate every week. Although 10% of Singaporeans state they purchase chocolate daily! In Australia 53% purchase weekly, whilst a further 26% buy on a fortnightly basis.

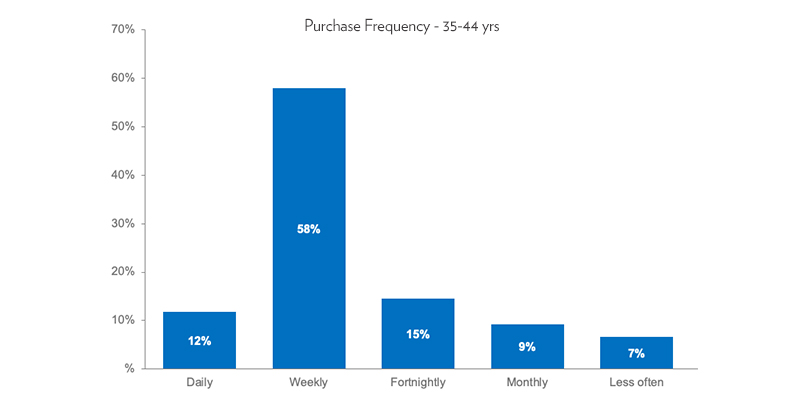

Chocoholics by Age

The 35-44 age group stands out as the most dedicated chocoholics, with 58% purchasing weekly. In the UK, this figure jumps to 71%, and even higher for the 45-54 age group at 77%. In Australia, young adults (18-24 years) are particularly fond of their chocolate, with 65% indulging weekly. Interestingly in Singapore it’s younger consumers who are purchasing most frequently with 37% of 18-24 year old’s purchasing daily or weekly and 55% of 25-34 year old’s having the same buying behaviour.

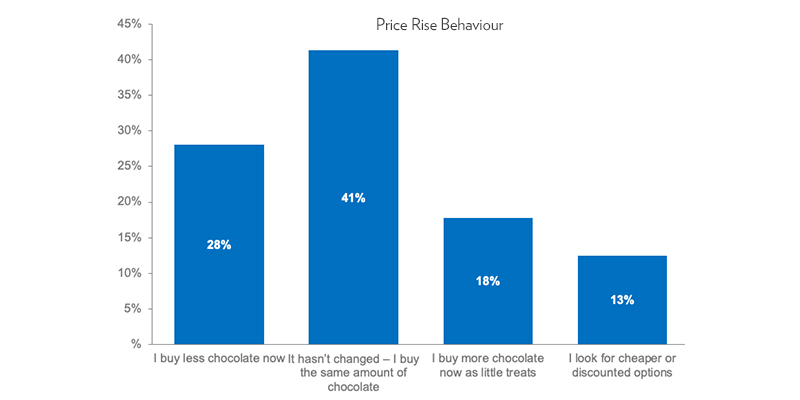

Economic Crunch

The rising cost of living has put a dent in chocolate purchases. Overall, 41% of respondents are either buying less chocolate or opting for cheaper options. This trend is most pronounced in Australia, with 45% affected, while in the UK, it’s 35% and 31% in Singapore.

Diving deeper into the stats, 53% of Australians aged 25-34 years (possibly new home buyers /people saving for a home deposit) state they are either buying less or purchasing cheaper brands on when their preferred brand is on special. In the UK this age group is also the most effected with 32% stating they buy less and a further 8% saying they look for cheaper options. Contrary to what’s happening in Australia and England, 35% of Singaporeans aged 25-34 years state they are buying more whilst a further 31% say that the cost of living hasn’t affected their chocolate buying behaviour.

Paying the Price: Impact of Rising Raw Goods Costs

Rising prices are having a polarising affect with 29% of respondents saying they are now buying less because chocolate is more expensive however 30% state they are willing to pay more for their favourite chocolate brands. A further 20% are trading down by purchasing the same amount but choosing cheaper brands.

Aussies certainly seem to be experiencing the greatest hardship with chocolate prices rising and 37% of respondents saying they are now buying less plus a further 27% stating the are switching to cheaper brands.

UK consumers show the highest brand loyalty, with 41% willing to pay a premium, compared to 29% of Singaporeans and only 20% of Australians.

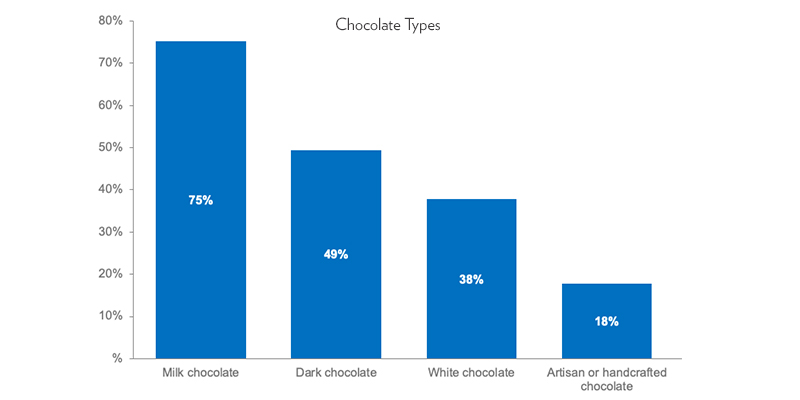

Milk Chocolate Reigns

Milk chocolate is the undisputed favourite, with 75% of respondents choosing it followed by dark and white chocolate. So, although milk chocolate is preferred, chocolate lovers are more than happy to mix it up! Interestingly, Singaporeans lean towards dark chocolate (67%) followed by milk (56%) then white (31%)!

The Artisan Appeal

Artisan chocolates are gaining popularity, especially in the UK and Singapore, where 22% of respondents in each region purchase them. In the UK interest is growing among Brits aged 35-44, with 43% making such purchases. In Australia, only 9% buy artisanal chocolates.

Anytime, Anywhere

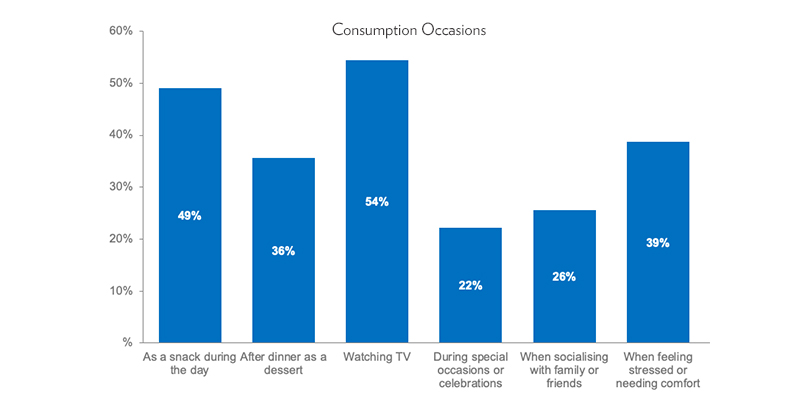

Chocolate is a versatile treat, enjoyed throughout the day by 49% of respondents and by 54% in front of the TV. In Singapore, 61% consume it as a daytime snack, and 50% for comfort during stressful times. Brits and Aussies prefer their chocolate with a good TV show (61% and 60% respectively), while 48% of Australians enjoy chocolate as a dessert after dinner.

Somewhat surprisingly 70% of those purchasing Artisan or handcrafted are doing so as a snack during the day.

A Little or a Lot

Consumption habits vary widely, with 36% eating a single row or equivalent at a time, and 25% indulging in multiple rows. Singaporeans are more restrained, with 36% eating only a small piece or square, compared to 13% of Aussies and 10% of Brits.

Aussies aged 35-44 and 55-64 are the heavy consumers with 57% and 62% respectively stating they consume multiple rows, half or a full family size block.

Interestingly, it’s Brits aged 25-34 years who are the heaviest consumers with 56% stating they eat multiple rows, half or a full family size block in one sitting. It’s the same in Singapore with consumers aged between 25-34 years the heaviest consumers at 34%.

The Health-Conscious Sweet Tooths

High cocoa content (70% or more) is the leading choice for health-oriented chocolate, purchased by 35% of respondents. Low-sugar options attract 25%. In Australia, 46% haven’t tried any health-oriented chocolates, while 45% of Singaporeans and 34% of Brits have purchased high-cocoa chocolate.

Key Implications for Manufacturers, Marketers, and Retailers

From our poll it’s evident that in many instances the market dynamics vary significantly from region to region. Therefore, marketing implications will be highly dependent of the market you are operating in. With this in mind, here are few suggestions on how to increase sales and build your brand.

Leverage Impulse Purchases: Position chocolate strategically at checkouts and isle ends to capitalise on impulse purchases.

Target Key Demographics: Focus marketing efforts on the 35-44 and 45-54 age groups, who show the highest weekly purchase rates. But don’t discount the younger audience (25-34) who are some of the highest consumers in one sitting.

Address Cost of Living Pressures: Offer promotional deals and value packs to attract cost-conscious consumers affected by economic pressures. Nobody likes shrinkflation but consider smaller pack sizes, priced accordingly, with the aim of gaining greater sales through impulse purchases or consumers not switching from your brand for a cheaper one.

Cultivate Brand Loyalty: Advertising can create value by making consumers feel good about your brand. If anything can live up to an advertising promise it’s chocolate!

New Product Development: Consider introducing health-oriented chocolate lines, particularly in Singapore and the UK, where there is strong interest in high-cocoa and low-sugar options. Given many chocolate lovers enjoy a variety of milk, dark and white chocolate, explore the idea of replicating best-selling products in other formats.

As Forrest Gump said, “Life is like a box of chocolates” and the chocolate market is indeed diverse reflecting varied consumer preferences and behaviours across different regions.

There are many other insights that can be gained from this study. If you would like to know more about our Focus On Chocolate poll please contact us.