As we pop the cork and raise our glasses, let’s dive into our very latest Focus On Poll, exploring wine purchase behaviour in Australia, Singapore, and the United Kingdom. Our poll explores key purchase drivers, shopping behaviours, preferred retailers, key occasions for wine consumption, and spending patterns. Pour yourself a glass and let’s get into it!

Why These Regions?

Like a great bottle of wine, each market has its own unique characteristics, but there are also some remarkable similarities. On International Wine Day we wanted to look at some of the key markets we work in.

Australia is a mature market, with a significant portion of the population enjoying wine regularly and a strong domestic production that offers a wide range of affordable, high-quality wines.

Singapore’s wine market is burgeoning, characterised by increasing interest and sophistication, creating evolving demand for variety and exclusivity, driven by social occasions and the influence of a globally connected, affluent population.

In the UK, wine enjoys considerable popularity but competes with the traditional beer and pub culture, although the trend of consuming wine at home is on the rise.

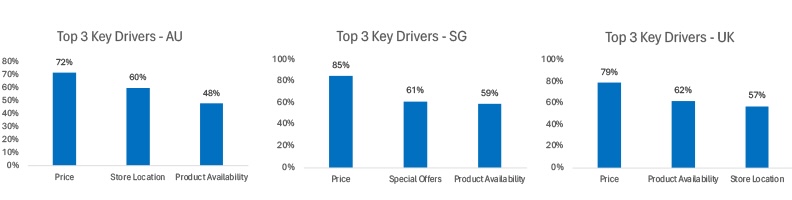

Price is King

Across all three countries, price stands out as the primary factor influencing wine purchases. In Singapore 85% of consumers state price as their top consideration, closely followed by the UK at 79% and Australia at 72%. This universal love for a good deal shows that whether it’s a buttery Chardonnay or a bold Shiraz, everyone loves good value and a bargain.

Diverse Drivers

Beyond price, wine lovers look for convenient shopping and a wide choice of wine varieties and labels/brands. In the UK, 62% value product availability, making sure their favourite tipple is always within reach. In Singapore, 61% can’t resist special offers, discounts and competitions, while 60% of Australians appreciate a conveniently located store. It’s clear, a well-stocked liquor store and easy access make for happy sippers.

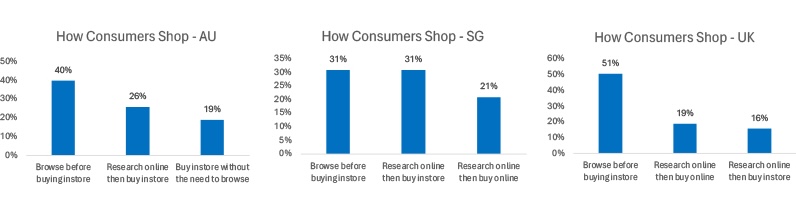

Purchase Behaviour

When it comes to shopping for wine, behaviour varies in each market. In the UK a little over half of shoppers love to browse in-store before choosing their bottle. Australians also enjoy the in-store experience, with 40% preferring to browse before they buy. In Singapore, 31% research online before making an in-store purchase, while 21% complete their purchase online.

This blend of traditional and digital shopping highlights the diverse paths to finding the perfect vino .

Big Retailers Dominate the UK and Australia

Retail purchase destinations vary significantly. In many ways this is due to the different liquor licensing laws ruling each country. As we know, in Australia the major players are the liquor barn franchises dominated by Dan Murphy’s, BWS and Liquorland. This preference for large retail chains underscores the convenience and broad selection they offer. However, in the UK you can purchase wine in supermarkets (how luck are they!) so the key supermarket chains Tesco, Asda, Sainsbury’s, and Aldi lead the pack for wine purchase destinations.

Singapore’s Unique Retail Scene

Singaporeans often purchase wine at Changi Airport Duty-Free, highlighting the appeal of tax-free shopping. How does that work we hear readers say? Changi Airport is not just a travel hub but also one of the largest shopping malls in Singapore, offering over 400 retail outlets. The extensive selection of products, including a vast range of wines makes it a convenient one-stop shop for locals alike. They also offer online shopping (ishopchangi) even if you are not travelling with good prices, often better than what is available in the city. Wine Connection, a popular retail and bistro chain, and specialist wine store Bottles & Bottles also feature prominently. These two outlets are known for their extensive selections and attractive promotions, catering to both casual buyers and connoisseurs.

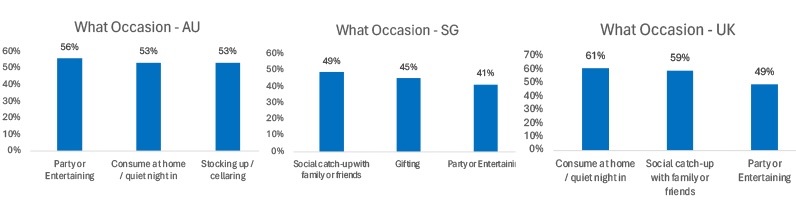

Cheers to Celebrations

Social gatherings and celebrations drive wine purchases across all three countries. In Singapore, 49% buy wine for casual catchups with friends and family, and 48% for gifting, reflecting a culture of sharing and generosity. On the other hand, Australians love a party with 56% buying wine for parties and entertaining. In the UK, a quiet night at home is the top occasion, with 61% savouring their wine in the comfort of their living room followed by social gatherings (59%) and parties (49%).

Diverse Spending

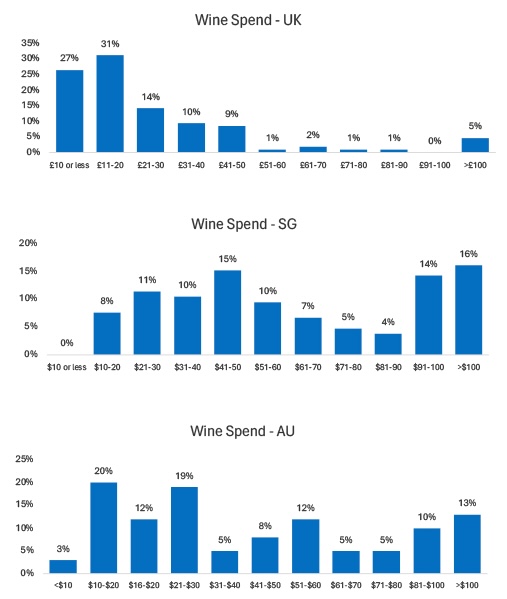

Wine spending varies widely, reflecting different market dynamics. In the UK, 27% of consumers stated they spent under £10 on their last wine purchase, while over 40% fall in the £11- £30 range, showing a preference for affordable wines. Singapore’s wine lovers are willing to splurge, with 30% spending over $90, often on gifts. Australians show a mix, with over 50% spending under $30, and 23% splurging over $90, reflecting a mix of budget-conscious and premium buyers.

Marketing Implications

So what does this all mean for wine companies, retailers, brands and marketers?

- Focus on Value: Emphasise value for money in marketing campaigns, given the importance of price across all markets.

- Ensure Product Availability: Maintain supply chains to keep popular products in stock, addressing the significant role of product availability.

- Optimise Online and In-store Integration: Develop strategies that bridge online research and in-store purchasing. As our recent Shopper Grocery Reports have highlighted, although many people are shopping in-store they are spending more time online researching product and prices beforehand.

- Leverage Social Occasions: Tailor marketing messages to highlight wine’s role in social gatherings and gifting, resonating with key purchase occasions.

- Cater to Varied Budgets: Recognise the diversity in spending habits and offer products that cater to both budget-conscious consumers and those seeking premium options.

- Expand Presence in Preferred Retail Channels: Strengthen partnerships with leading retailers and explore opportunities in unique venues like wine specialty stores for wine lovers to experience your vino.

Let’s celebrate not only the wine in our glasses but the diverse and delightful ways we all enjoy it. Cheers!

If you would like to know more about our Focus On Wine Insights poll please contact us.