In the wake of high inflation and interest rate impacts, supermarket behaviour is being driven by cost of living constraints more than ever, as shoppers go to greater lengths in their search for better value.

After years of Covid related disruption, we are now seeing a relatively stable trading environment dominated by concerns around price inflation and the cost of a weekly shop, where major retailers continue to drive consistent messaging about value and keeping a lid on prices.

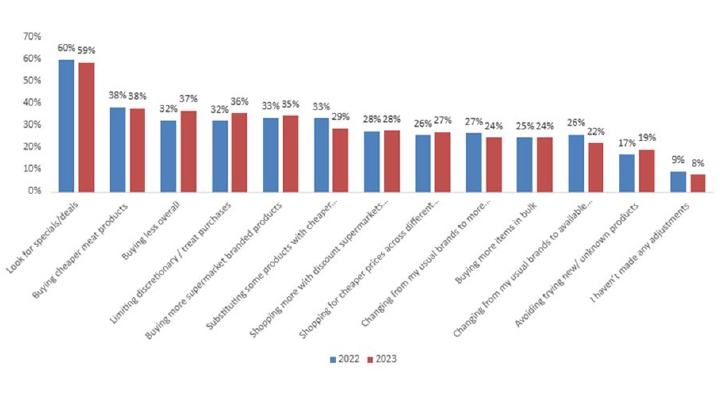

The results coming through from our 2023 Grocery Shopper Report, reinforce some key shopper behaviours and preferences that developed over the last year; with more than 45% of consumers indicating price rises are having a major impact on their shopping. In response to the rising cost of living pressures, 59 per cent of shoppers are looking for promotions and deals, with 38 per cent of shoppers now buying cheaper cuts of meat. We are now also seeing an increasing number of shoppers; more than 1 in 3, also limiting discretionary / treat purchases.

Fig 1. In which ways have you adjusted your shopping due to the rising cost of living pressures?

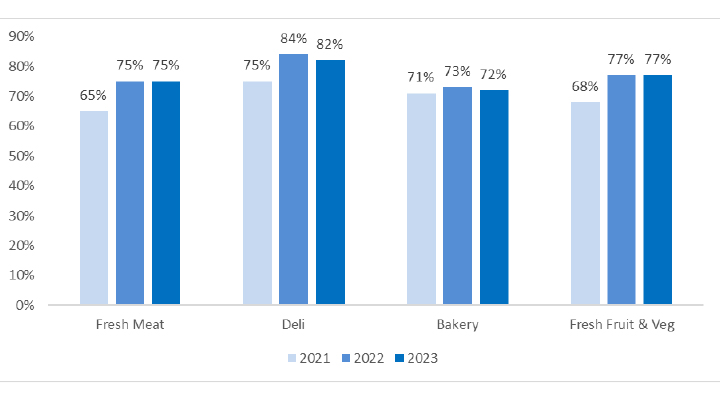

Whilst Fruit, Vegetables and Red Meat prices are now starting to come down, other areas of the store such as Dairy, Bread & Cereals have been further impacted by price inflation. Fresh continues to be an important battleground for Supermarkets where we see gains made coming out of covid largely consolidated. However slight shifts back to Delicatessens and Bakeries highlight that major retailers need to ensure they continue to meet the shoppers’ needs for quality, range and value.

Fig 2. How often do you buy these fresh products from a supermarket?

Beyond just promotions and EDLP, reward card points usage is also featuring more heavily as shoppers seek further ways to stretch their budget. In particular, Gen Z and Millennials are especially using points more than the average shopper. Woolworths Rewards again tops the list of most used reward program at 68% followed by Coles Fly Buys at 61%, both up vs YA.

For those feeling the squeeze across the mortgage belt and beyond, we expect there will be no change in the desire to hunt for value in the coming year ahead, and the need for retailers and suppliers to continue to address these needs. This means it is essential to understand the role of your brand in the category, which promotions resonate most with your shoppers, what prices are acceptable for your products, and how can private label and the right branded offers best support shoppers value needs.

Be the first to know how business brands can make better decisions with our 2023 Grocery Shopper Report. Request your copy today.